How to Vet Nearshore Software Development Companies: A Complete Evaluation Guide

- Leanware Editorial Team

- 4 hours ago

- 15 min read

Choosing a nearshore software development partner is one of the more consequential decisions a technical leader will make. Get it right, and you gain a capable, collaborative team that expands your engineering capacity. Get it wrong, and you're looking at delayed timelines, technical debt, and a costly vendor switch mid-project.

Let’s break down how to vet nearshore vendors, including evaluation criteria, red flags, contract structures, and the essential questions to ask before signing anything.

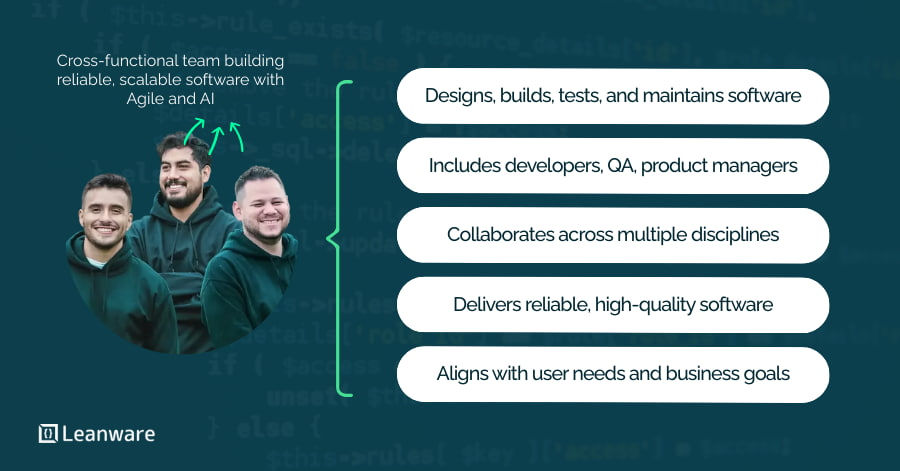

What Is a Nearshore Software Development Company?

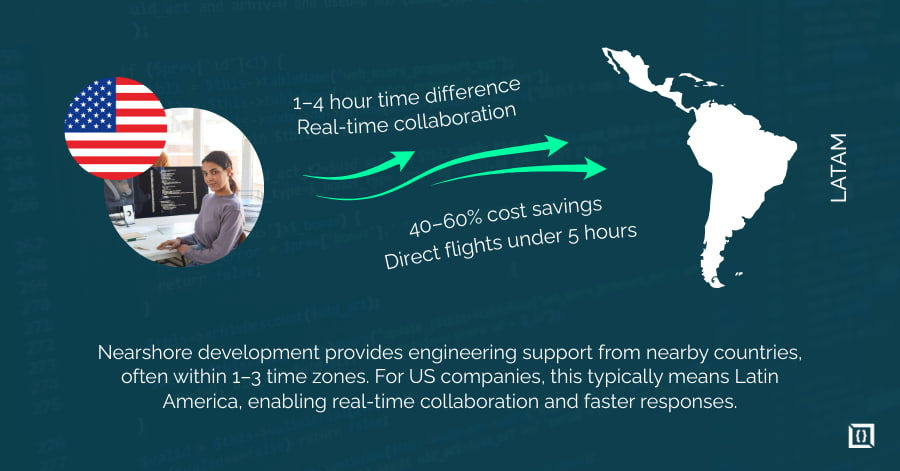

A nearshore software development company provides engineering services from a neighboring country or region, typically within one to three time zones of the client. For US-based companies, nearshore most commonly means Latin America - countries like Mexico, Colombia, Brazil, Argentina, and Costa Rica.

The proximity matters for operational reasons: overlapping work hours make daily standups and real-time collaboration feasible. You are not coordinating across a 10-hour gap or waiting until the next morning to get a response on a critical bug.

Nearshore vs Offshore vs Onshore Development

Factor | Onshore | Nearshore | Offshore |

Location | Same country | Adjacent region/country | Distant country |

Time zone overlap | Full | Partial to full (1–3 hrs difference) | Minimal to none |

Typical cost | Highest | Mid-range | Lowest |

Communication ease | Easiest | High | More challenging |

Cultural alignment | High | High | Variable |

Talent pool | Limited | Growing rapidly | Large |

Offshore gives you the most cost savings, but managing a team 10+ time zones away creates coordination friction. Onshore maximizes collaboration but is the most expensive. Nearshore provides an effective alternative, meaningful cost reduction without sacrificing the collaboration quality that agile development depends on.

Why Companies Choose Nearshore Development

Primary factors driving companies to choose nearshore partners include:

Cost efficiency: Companies can reduce development costs by 30-50% compared to onshore hiring, without the communication overhead that often comes with pure offshore engagements.

Talent access: Latin America has become a cost-effective IT talent hub for US companies, with skilled software developers available at rates of $45-65 per hour.

Collaboration quality: Time zone overlap means your nearshore team participates in real sprints, not delayed task transfers.

Cultural alignment: Shared business culture reduces the friction that often shows up in communication style, decision-making, and work expectations.

Why Vetting Nearshore Vendors Matters

The nearshore market is expanding rapidly. The Global Software Development Outsourcing Market is expected to grow from USD 534.9 billion in 2024 to around USD 940.0 billion by 2034, at a CAGR of 5.8%. With that growth comes a wider range of vendor quality. More options mean more due diligence is required, not less.

Picking the wrong vendor does not just cost money - it costs time, which is often harder to recover.

Common Risks of Choosing the Wrong Vendor

Even small gaps in vendor capability can lead to delays, accumulating technical debt, and operational slowdowns, so it’s important to understand the specific risks upfront.

Delayed delivery: Teams that overpromise on timelines often lack the project management infrastructure to recover when things slip.

Technical debt: A vendor focused on short-term delivery speed may ship code that creates long-term maintenance problems your internal team then inherits.

Security exposure: Vendors without clear security practices can introduce vulnerabilities through poor access control, unencrypted data handling, or weak SDLC practices.

Hidden costs: Fixed-price contracts with scope ambiguity often result in costly change orders. Hourly models without clear governance can balloon.

Communication breakdown: Inconsistent reporting and vague status updates are a warning sign that either the process or the English proficiency is not what was presented in the sales process.

Factors That Predict Successful Partnerships

Specific operational behaviors in a vendor’s day-to-day work can indicate whether a partnership will run smoothly:

Transparent, proactive communication - not just responsiveness when you reach out

A defined delivery process (sprint reviews, velocity tracking, retrospectives).

Senior engineers who are actually assigned to your project, not just to sales conversations.

Security and compliance practices that are documented, not improvised.

Realistic scoping rather than telling you what you want to hear.

How to Vet Nearshore Software Development Companies

The following framework gives you a structured way to evaluate vendors before committing. Each step builds on the previous one, so work through them in order.

Step 1: Define Your Project Requirements and Scope

Before evaluating any vendor, you need to be clear internally on what you are actually asking for. Vendors will calibrate their proposals to whatever information you provide - vague requirements lead to vague proposals.

Define the following before your first vendor call:

Project goals and success criteria

Technology stack preferences or requirements

Team structure (dedicated team, staff augmentation, or project-based)

Timeline and milestone expectations

Budget range and flexibility

Internal stakeholders and decision-making process

Compliance requirements (HIPAA, GDPR, SOC 2, etc.)

This upfront clarity also helps you evaluate how well vendors listen and ask questions versus how quickly they jump to a pitch.

Step 2: Evaluate Technical Expertise and Engineering Capabilities

Technical skill is the foundation. The challenge is that vendors can present polished capabilities pages without those capabilities translating to actual project performance.

Dig deeper by:

Requesting a technical interview with the engineers assigned to your project.

Reviewing code samples or a brief take-home assessment.

Asking architecture questions relevant to your stack: scalability, stateful vs stateless services, CI/CD structure.

Checking relevant certifications (AWS, GCP, Azure) where applicable.

Asking about testing practices: unit tests, integration tests, QA coverage.

The goal is to assess real capability, not just familiarity with technology names.

Step 3: Review Portfolio and Case Studies

A strong portfolio shows not just what the vendor built, but what outcomes were achieved. Look for specifics. Generic descriptions like "we built a mobile app for a healthcare client" tell you very little.

Good case studies include:

The problem the client was solving

The team composition and engagement model

Technical decisions made and why

Measurable results (load time improvements, uptime, release frequency, user growth)

Any challenges encountered and how they were resolved

If a vendor only shows you logos without details, that is worth probing. Ask them to walk you through a specific project in depth.

Step 4: Check Client Reviews and References

Third-party validation is one of the most reliable signals you have. Check platforms like Clutch, G2, and LinkedIn for reviews. Look at how recent the reviews are - a company with strong ratings from three years ago may look different today.

When talking to references, ask:

Was the team you worked with senior, or did senior engineers disappear after onboarding?

How did the vendor handle a significant problem or setback during the project?

How did they communicate during the project - proactively or reactively?

Would you hire them again for a similar project?

The last question is a reliable indicator. Clients who hedge their answer often have a reason.

Step 5: Assess Communication and Cultural Alignment

Communication is where many nearshore engagements break down. The time zone advantage disappears quickly if the team is hard to reach, gives vague status updates, or cannot have real-time technical conversations.

Assess this during your evaluation:

Video call with the technical lead and project manager.

Checking English fluency - practical, not perfect.

Understanding their communication channels (Slack, email, project tools).

Confirming standard meeting cadence.

Asking how they handle disagreements or escalate issues.

Cultural alignment matters too. Ask how the team handles disagreement with a client decision, or how they escalate a technical concern. A team that will push back when they see a risk is more valuable than one that always agrees.

Step 6: Evaluate Development Process and Methodology

A well-run nearshore team operates with a defined process. If a vendor cannot describe their sprint structure, definition of done, or QA workflow in concrete terms, that is a problem.

Ask specifically:

What does a sprint cycle look like from kickoff to delivery?

How do you handle bugs found in production versus during QA?

What tools do you use for project management, code review, and deployment?

How is code quality enforced - peer review, static analysis, automated testing?

What is your release process, and how do you handle rollbacks?

Vendors running a mature process can answer these questions quickly and specifically. Those improvising will give you generalities.

Step 7: Review Security and Compliance Standards

For any project handling user data, financial information, or operating in a regulated industry, security practices are non-negotiable. You need to understand how the vendor handles:

Data access: who can reach your codebase and production data.

Secure development: input validation, dependency and secrets management.

Compliance: GDPR, HIPAA, SOC 2, PCI-DSS as relevant.

IP ownership: ensure all project IP reverts to you.

NDA coverage: confirm it applies to all assigned personnel.

Third-party audits or penetration testing of their infrastructure.

Ask whether they have undergone any third-party security audits or penetration testing on their internal infrastructure.

Step 8: Verify Team Structure and Talent Quality

One of the more common issues in nearshore engagements is misrepresentation of team seniority. A vendor may pitch senior engineers, then assign mid-level or junior developers once the contract is signed.

Protect against this by:

Requesting CVs of engineers assigned to your project

Interviewing those engineers directly

Checking engineer-to-client ratios

Asking about team turnover and retention

A vendor with high retention and a stable team is significantly easier to work with over 12+ months.

Step 9: Analyze Pricing Models and Contract Terms

Nearshore vendors usually offer three main pricing models:

Time and materials: Pay for actual hours; track scope carefully.

Fixed price: Set cost for defined deliverables; works with clear requirements.

Dedicated team: Monthly retainer for a team; best for ongoing work.

Look closely at contract details: minimum commitments, notice for team changes, rates for extra resources, dispute resolution, and data deletion policies. It’s better to focus on the total cost of engagement rather than just the hourly rate - the cheapest option can end up costing more in the long run.

Step 10: Run a Pilot Project Before Full Engagement

A short, paid pilot is the most reliable way to evaluate a vendor. You get real performance data - how they communicate, how they handle ambiguity, whether they deliver what they say they will, and how their code actually looks.

Scope the pilot as a meaningful but bounded piece of work: a feature, a refactor, an API integration. Avoid giving them trivial tasks that do not reflect actual project complexity.

After the pilot, you have the information to make a confident decision, and you have done so with limited exposure.

Criteria to Evaluate Nearshore Development Companies

When comparing vendors, these are the dimensions that matter most.

1. Technical Expertise and Technology Stack Experience

Look for alignment with your stack. A team familiar with Node.js and React will ramp up faster on a JavaScript project than one focused on Java. Also consider system design experience - have they handled systems at the scale and complexity your project requires?

2. Communication and Time Zone Compatibility

Daily collaboration depends on overlapping hours. For US teams working with LATAM vendors, this often gives 4-8 overlapping business hours.

Confirm the overlap and whether the team commits to being available synchronously during those hours.

3. Process Maturity and Delivery Standards

Predictable delivery comes from repeatable processes. Vendors with a mature development process - documented sprint workflows, QA standards, code review requirements - are more likely to deliver consistently than teams that rely on individual effort and heroics.

4. Cultural and Business Alignment

This is harder to quantify but consistently shows up in performance. Teams that share a similar work culture around transparency, directness, and accountability tend to build better client relationships.

Ask during evaluation how they handle a situation where they disagree with a client's technical direction.

5. Security, Compliance, and Data Protection

Security is an operational concern, not just a compliance checkbox. A vendor that cannot explain their access control policies or has never heard of a secure software development lifecycle (SSDLC) is a risk - especially if your product handles sensitive data.

6. Cost vs Value Assessment

A lower hourly rate does not automatically mean lower total cost. Rework, miscommunication, and delayed delivery from a cheaper vendor often costs more than the premium for a higher-quality one. Evaluate vendors on the value they deliver, not the rate they charge.

Vendor Decision Matrix

To make a structured comparison, you can score each vendor across important criteria and apply weights to reflect their relative importance.

Criteria | Weight | Vendor A | Vendor B | Vendor C |

Technical expertise | 25% | /10 | /10 | /10 |

Communication quality | 20% | /10 | /10 | /10 |

Process maturity | 15% | /10 | /10 | /10 |

Cultural alignment | 10% | /10 | /10 | /10 |

Security practices | 15% | /10 | /10 | /10 |

Pricing transparency | 10% | /10 | /10 | /10 |

Proven results | 5% | /10 | /10 | /10 |

Weighted total | 100% |

Questions to Ask Before Hiring a Nearshore Development Partner

Use these questions during the interview phase to peel back the layers of a vendor’s sales pitch.

Technical and Architecture Questions

What is your experience with [your specific stack]? Can you share relevant examples?

How do you approach system design for applications that need to scale to [X] users?

What does your automated testing coverage look like on a typical project?

How do you handle technical debt - is there a process for tracking and addressing it?

Process and Project Management Questions

Walk me through how you manage a sprint from kickoff to demo.

How do you handle missed deadlines or unexpected scope changes?

What does your reporting look like - how do we know what progress was made each week?

What project management tools do you use, and how do you give clients visibility?

Security and Compliance Questions

Who on your team has access to client codebases and data, and how is that controlled?

Have you worked with projects requiring HIPAA or GDPR compliance? What did that involve?

How do you manage dependencies and track vulnerabilities in third-party libraries?

What happens to our data and code if the engagement ends?

Team and Collaboration Questions

Can we interview the specific developers who would be assigned to our project?

What is your current engineer turnover rate?

If a key developer needs to leave our project, how do you handle knowledge transfer?

What are your standard working hours, and how much overlap would we have with our team in [your timezone]?

Red Flags When Vetting Nearshore Software Development Companies

Before committing to a vendor, recognize warning signs in communication, pricing, portfolio, and process that can signal potential problems.

Warning Signs in Vendor Communication

Notice how the vendor interacts during evaluation - patterns here often reflect how the team will operate once work begins.

They take more than 24 hours to respond to emails during the sales process - this does not improve after you sign a contract.

Their technical answers are vague or pivot quickly to non-technical talking points.

They cannot answer follow-up questions without "checking with the team".

You never speak to an actual developer during the evaluation process.

Pricing Red Flags

Opaque billing or unusual pricing practices can indicate hidden costs or misaligned expectations.

Rates that are significantly below market for their claimed seniority level - this typically means junior engineers, high turnover, or a bait-and-switch on personnel.

Contracts with no clear hourly tracking or reporting mechanism.

Additional fees that appear during contract negotiation that were not mentioned upfront.

Portfolio and Experience Concerns

Review the vendor’s past work carefully - superficial case studies or unverifiable claims are a red flag.

Case studies with no specific outcomes, metrics, or client names.

Claimed experience in technologies with no developers who can speak to those projects in an interview.

Long client lists with no willingness to provide reference contacts.

Process and Delivery Risks

A vendor’s ability to explain their workflow and quality controls shows whether they can deliver consistently.

Cannot describe their sprint process in concrete terms.

No QA workflow beyond "we test before we deliver".

No documented approach to code review or quality standards.

Reluctance to agree to a pilot project.

Nearshore Vendor Evaluation Framework

(Enterprise Approach)

For enterprise buyers running a formal vendor selection process, a weighted scoring model provides a defensible, consistent basis for comparison.

Weighted Scoring Model for Vendor Selection

Criteria | Weight | Scoring Guidance |

Technical expertise | 25% | Stack depth, architecture capability, testing practices |

Communication quality | 20% | Response speed, clarity, English proficiency, availability |

Process maturity | 15% | Defined sprint process, QA standards, delivery predictability |

Security and compliance | 15% | Access control, SDLC practices, compliance experience |

Cultural alignment | 10% | Communication style, feedback culture, business compatibility |

Pricing transparency | 10% | Clear rate structure, no hidden fees, contract clarity |

Portfolio and references | 5% | Verified outcomes, reference quality, industry relevance |

Score each vendor 1-10 on each criterion, multiply by weight, and sum for a final score. This does not replace judgment, but it creates a consistent basis for comparison across multiple vendors.

Example Vendor Comparison Table

Scoring and weighting each criterion provides a clear, objective view of how vendors compare across technical skills, communication, processes, and other factors.

Criteria | Weight | Vendor A Score | Weighted A | Vendor B Score | Weighted B |

Technical expertise | 25% | 8 | 2.00 | 7 | 1.75 |

Communication quality | 20% | 9 | 1.80 | 6 | 1.20 |

Process maturity | 15% | 7 | 1.05 | 8 | 1.20 |

Security and compliance | 15% | 8 | 1.20 | 7 | 1.05 |

Cultural alignment | 10% | 9 | 0.90 | 7 | 0.70 |

Pricing transparency | 10% | 7 | 0.70 | 9 | 0.90 |

Portfolio and references | 5% | 8 | 0.40 | 7 | 0.35 |

Total | 100% | 8.05 | 7.15 |

Best Practices for Choosing the Right Nearshore Partner

Beyond the checklists, keep these three strategic principles in mind:

Prioritize Long-Term Partnership Over Short-Term Cost: A cheaper vendor who builds a product that breaks under load will cost you more in lost revenue than a premium partner would have cost upfront.

Start With Small Engagements: Don't outsource your entire roadmap on day one. Start with a single feature or a standalone module to test the integration.

Establish Clear KPIs and Expectations: Define what success looks like in the contract. This should include code coverage percentages, uptime requirements, and bug-fix turnaround times.

Benefits of Properly Vetting Nearshore Development Companies

Proper vetting reduces project risk, improves collaboration, and helps control long-term costs. A thorough evaluation filters out vendors who cannot deliver what they claim, resulting in fewer surprises, more predictable delivery, and code that your internal engineers can maintain and build on.

Nearshore teams can finish projects faster than offshore alternatives because real-time communication eliminates coordination delays. When you assess communication quality upfront, that advantage becomes consistent rather than intermittent.

Getting the vendor selection right the first time also prevents costly rework and technical debt. Spending time on evaluation may feel slower initially, but it is far less expensive than switching vendors mid-project or managing long-term maintenance issues.

How to Choose Between Multiple Nearshore Vendors

If you have two vendors who both seem technically capable, the tie-breaker should always be cultural and communication fit.

Compare their proposals side-by-side. Look at the specific names of the people they are proposing for your team. Are they the same people who did the technical interview? If not, ask why.

The final decision should be based on who you trust to tell you the truth when a project hits a snag - because every software project eventually does.

Your Next Step

Vetting a nearshore vendor is not a single conversation - it is a structured process that takes time and specificity.

The companies that have the best outcomes with nearshore development do not just find a vendor. They find a team that they can work with honestly, that communicates problems early, that holds technical standards without being managed toward them, and that is invested enough in the relationship to get better at understanding the product over time.

You can also connect with us to get guidance on evaluating nearshore vendors and selecting a partner that fits your technical and business needs.

Frequently Asked Questions

What is a nearshore software development company?

A nearshore software development company provides engineering services from a nearby country, typically within one to three time zones of the client. For US companies, this most commonly means Latin America. The geographic proximity enables real-time collaboration, unlike offshore outsourcing where large time zone gaps create coordination friction.

How do you vet a nearshore software development company?

Vet a nearshore company by evaluating their technical expertise through direct interviews with assigned engineers, reviewing case studies with specific outcomes, checking client references on platforms like Clutch, assessing communication quality in real conversations, verifying security practices and compliance experience, analyzing pricing transparency, and running a paid pilot project before committing to a full engagement.

What should you look for in a nearshore development partner?

Focus on technical experience relevant to your stack, English communication fluency, a defined and mature development process, cultural alignment with your organization's work style, documented security practices, transparent pricing, and verifiable delivery results with references you can speak to directly.

Why is vetting nearshore vendors important?

Poor vendor selection leads to delayed projects, technical debt your internal team inherits, cost overruns through hidden fees or scope mismanagement, and potential security exposure. A structured vetting process reduces these risks substantially and improves the probability of a successful, long-term partnership.

How do companies evaluate nearshore software development vendors?

Most structured evaluations involve a technical assessment of the team, a portfolio review with case study analysis, direct reference calls with past clients, a security and compliance review, contract and pricing analysis, and a pilot project to validate real-world performance before full engagement.

What questions should you ask a nearshore software development company before hiring?

Cover four areas: technical expertise (stack depth, architecture approach, testing practices), development process (sprint structure, QA standards, tooling, reporting), security and compliance (access control, data handling, IP ownership), and team structure (assigned developers, availability, turnover, communication style).

How do you check a software vendor's technical expertise?

Hold a technical interview directly with the engineers who would work on your project. Ask architecture-level questions relevant to your domain. Review code samples or request a brief technical assessment. Verify any claimed certifications. Ask how they approach testing and code quality. The goal is to validate real capability, not just resume items.

How do you verify a nearshore company's experience and portfolio?

Ask vendors to walk you through specific projects in detail, including the problem, their technical decisions, and measurable results. Request client references and ask those clients direct questions about team performance. Look for complexity in their past work that is comparable to yours. Generic case studies without metrics or client details are a weak signal.

Should you run a pilot project before hiring a nearshore team?

Yes. A pilot gives you real performance data that no sales conversation or reference call can fully replicate. Scope it as a meaningful piece of work - not trivial, but bounded. After a pilot, you know how the team communicates, how they handle ambiguity, and what their code actually looks like. That information is worth far more than anything presented in a proposal.

How do you compare multiple nearshore software vendors?

Use a weighted scoring framework that evaluates technical expertise, communication quality, process maturity, security standards, cultural fit, pricing transparency, and proven results. Score each vendor consistently, then overlay that with reference call quality and pilot project performance. A side-by-side proposal comparison against the same brief also reveals a lot about how each vendor thinks through a problem.

.webp)